Diem Burden Popular Books

Diem Burden Biography & Facts

Per diem (Latin for "per day" or "for each day") or daily allowance is a specific amount of money that an organization gives an individual, typically an employee, per day to cover living expenses when travelling on the employer's business. A per diem payment can cover part or all of the expenses incurred. For example, it may include an accommodation allowance or it may only cover meals (with actual accommodation costs reimbursed separately or be prepaid). Travel, particularly by motor vehicles, is often reimbursed at a rate determined only by distance travelled, e.g., the US business mileage reimbursement rate. Fixed per diem (and per mile) rates eliminate the need for employees to prepare, and employers to scrutinise, a detailed expense report with supporting receipts to document amounts spent while travelling on business. Instead, employers pay employees a standard daily rate without regard to actual expenditure. In some countries, the income tax code specifies a maximum daily allowance: although an employer may pay a higher rate, the excess is subject to income tax. United Kingdom Accommodation and subsistence (meals) payments paid as fixed daily amounts are described as "scale rate expenses payments" by HM Revenue & Customs (HMRC). HMRC guidance does not use the term "per diem", but it is used by some organisations. HMRC allows scale rate expenses payments for income tax purposes for travel within the UK, and allows a dispensation for such payments for travel abroad. United States U.S. companies and organizations use the per diem rate guide published by the General Services Administration which provides rates for a number of cities in the Continental United States. For locations in the US outside the continental US, including Alaska, Hawaii and the US territories and possessions, per Diem rates are published by the Per Diem, Travel and Transportation Allowance Committee (also known as the Per Diem Committee or PDTATAC). For all foreign locations, per Diem rates are established by the Department of State. Per diem is understood to include the additional expenses incurred living away from home—basically the need to have two residences. The GSA establishes per diem rates within the Continental United States for hotels "based upon contractor-provided average daily rate (ADR) data of fire-safe properties in the local lodging industry"; this means that per diem varies depending on the location of the hotel—for instance, New York City has a higher rate than Gadsden, Alabama. To qualify for a per diem, work-related business activity generally requires an overnight stay. The IRS code does not specify a number of miles. However, based on case precedent and IRS rulings, it is commonly accepted that an overnight stay must genuinely be required and actually occurs, to justify payment of per diem allowance. The purpose of the per diem payment (or the deduction of expenses when inadequate reimbursements are provided) is to alleviate the burden on taxpayers whose business or employment travel creates duplicated expenses. The US military pays its members per diem in accordance with the Joint Travel Regulations. According to these regulations, the first and last days of travel are paid 75% of the daily General Services Administration, PDTATAC, or DOS rate, while all other days of travel receive the full rate. The JTR also states that lodging taxes for CONUS and non foreign OCONUS are a reimbursable expense but requires a receipt. The JTR also follows the 'expenses below $75 do not require a receipt' rule, established by the Internal Revenue Service although local disbursing officers may question charges they feel may be false. The US Government also allows federal employees to purchase a home at the temporary duty location and claim the allowable expenses of: mortgage interest, property taxes and utility costs actually incurred. In addition, truck drivers have a special way of calculating a tax deduction for per diem. All drivers who are subject to USDOT hours of service are eligible. As of October 1, 2009, the per diem rate is $59 per day, and they may deduct 80% of this amount from their taxable income. Due to the large number of away games and associated travel days in American sports, per diem rates are often major components in collective bargaining agreements between leagues and their players' unions. As of 2016, the NBA has the highest per-diem for players at $115 per day, followed by the NHL whose per-diem began at a base of $100/day in 2012–13 and is adjusted each year based on changes in the US Consumer Price Index. Minor pro and collegiate athletes also receive meal money for overnight trips, usually paid as a rate set by the league or university they are affiliated with. As athlete salaries have risen, per diems have occasionally become a contentious issue when negotiating CBAs: for instance, in 2016 Major League Baseball slashed allowances from $100/day to $35/day, citing high salaries and teams now providing pre- and post-game food to players on the road as their rationale. Railroads For American railroads, per diem is a charge railroads levy when their freight cars are on other railroad's property, to assure prompt return. Contract law Per diem clauses may be used in contracts to specify penalty accruals. Such wording would be found in reference to the expected closing date for a real estate contract, typically compensating a seller for a buyer's lack of expedience.. Russia Per diem in Russia is normally set up by companies but in accordance with the legislation cannot be lower than 700 ₽ for travel in Russia and 2500 ₽ for travel outside of Russia. If employees pay for a hotel in cash or with a payment card, then they must retain any billing invoices (Russian: кассовый чек, romanized: kassovy check). The regulations governing the use of invoices by business entities allow certain taxpayers to produce handwritten receipts (Russian: квитанция, romanized: kvitantsia) at a point of sale instead of printed invoices. Handwritten receipts usually contain the same information as receipts and invoices and are treated as sufficient evidence of expense. Per diem allowance Generally a per diem allowance covers: Cost of meal; Fees and tips for services; Laundry, dry cleaning etc.; Room service. Russian tax regulations do not provide for any alternative to per diem method for reimbursing employee's meal cost and incidental expenses. Meal costs and other incidental expenses cannot be treated as deductible expenses because they are already covered by per diem allowances. Meals may be treated as deductible expenses only if they qualify as hospitality expenses. Companies are free to set their own per diem rates or maximum allowances that employees are reimbursed for expenses incurred while on business trip. The portion of per diem allowance in excess of 700 ₽ for travel in Russia and 2,500 ₽ for travel outside Russia is deemed employee's taxable income. The ex.... Discover the Diem Burden popular books. Find the top 100 most popular Diem Burden books.

Best Seller Diem Burden Books of 2024

-

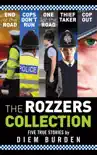

The Rozzers Collection

Diem BurdenThe five books of The Rozzers series are presented here in one large volume, each detailing the various stages of a police career in Cambridge in the 1990s.END OF THE ROADThis is a...

-

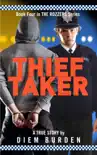

Thief Taker

Diem BurdenWith police college a distant memory, Constable Burden quickly becomes one of the most experienced officers on his shift. Just a handful of years separate that awkward, nervous roo...

-

Cop Out

Diem BurdenOfficer Burden finally passes his drawnout promotion exams and gets bumped up to sergeant, a job he's been chasing after for a number of years. On receiving his stripes, he is told...

-

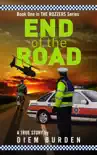

End of the Road

Diem BurdenWhat is it about cops that we find so intriguing? Most people have strong views of the police, but how many of these views are based on evidence, and which are biased or stereotype...

-

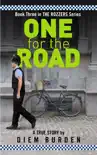

One for the Road

Diem BurdenHaving completed his initial training, rookie cop PC 424 Burden has been authorised for solo patrol, and nervously takes to the streets of the beautiful university city of Cambridg...