Meta S Brown Popular Books

Meta S Brown Biography & Facts

Meta Platforms, Inc., doing business as Meta, and formerly named Facebook, Inc., and TheFacebook, Inc., is an American multinational technology conglomerate based in Menlo Park, California. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta ranks among the largest American information technology companies, alongside other Big Five corporations Alphabet (Google), Amazon, Apple, and Microsoft. The company was ranked #31 on the Forbes Global 2000 ranking in 2023. Meta has also acquired Oculus (which it has integrated into Reality Labs), Mapillary, CTRL-Labs, and a 9.99% stake in Jio Platforms; the company additionally endeavored into non-VR hardware, such as the discontinued Meta Portal smart displays line and presently partners with Luxottica through the Ray-Ban Stories series of smartglasses. Despite endeavors into hardware, the company relies on advertising for a vast majority of its revenue, amounting to 97.8 percent in 2023. Parent company Facebook, Inc. rebranded as Meta Platforms, Inc. on October 28, 2021, to "reflect its focus on building the metaverse", an integrated environment linking the company's products and services. History Facebook filed for an initial public offering (IPO) on January 1, 2012. The preliminary prospectus stated that the company sought to raise $5 billion, had 845 million monthly active users, and a website accruing 2.7 billion likes and comments daily. After the IPO, Zuckerberg would retain 22% of the total shares and 57% of the total voting power in Facebook. Underwriters valued the shares at $38 each, valuing the company at $104 billion, the largest valuation to date for a newly public company. On May 16, one day before the IPO, Facebook announced it would sell 25% more shares than originally planned due to high demand. The IPO raised $16 billion, making it the third-largest in US history (slightly ahead of AT&T Mobility and behind only General Motors and Visa). The stock price left the company with a higher market capitalization than all but a few U.S. corporations—surpassing heavyweights such as Amazon, McDonald's, Disney, and Kraft Foods—and made Zuckerberg's stock worth $19 billion. The New York Times stated that the offering overcame questions about Facebook's difficulties in attracting advertisers to transform the company into a "must-own stock". Jimmy Lee of JPMorgan Chase described it as "the next great blue-chip". Writers at TechCrunch, on the other hand, expressed skepticism, stating, "That's a big multiple to live up to, and Facebook will likely need to add bold new revenue streams to justify the mammoth valuation." Trading in the stock, which began on May 18, was delayed that day due to technical problems with the Nasdaq exchange. The stock struggled to stay above the IPO price for most of the day, forcing underwriters to buy back shares to support the price. At the closing bell, shares were valued at $38.23, only $0.23 above the IPO price and down $3.82 from the opening bell value. The opening was widely described by the financial press as a disappointment. The stock nonetheless set a new record for trading volume of an IPO. On May 25, 2012, the stock ended its first full week of trading at $31.91, a 16.5% decline. On May 22, 2012, regulators from Wall Street's Financial Industry Regulatory Authority announced that they had begun to investigate whether banks underwriting Facebook had improperly shared information only with select clients rather than the general public. Massachusetts Secretary of State William F. Galvin subpoenaed Morgan Stanley over the same issue. The allegations sparked "fury" among some investors and led to the immediate filing of several lawsuits, one of them a class action suit claiming more than $2.5 billion in losses due to the IPO. Bloomberg estimated that retail investors may have lost approximately $630 million on Facebook stock since its debut. S&P Global Ratings added Facebook to its S&P 500 index on December 21, 2013. On May 2, 2014, Zuckerberg announced that the company would be changing its internal motto from "Move fast and break things" to "Move fast with stable infrastructure". The earlier motto had been described as Zuckerberg's "prime directive to his developers and team" in a 2009 interview in Business Insider, in which he also said, "Unless you are breaking stuff, you are not moving fast enough." 2018–2020: Focus on the metaverse Lasso was a short-video sharing app from Facebook similar to TikTok that was launched on iOS and Android in 2018 and was aimed at teenagers. On July 2, 2020, Facebook announced that Lasso would be shutting down on July 10. In 2018, the Oculus lead Jason Rubin sent his 50-page vision document titled "The Metaverse" to Facebook's leadership. In the document, Rubin acknowledged that Facebook's virtual reality business had not caught on as expected, despite the hundreds of millions of dollars spent on content for early adopters. He also urged the company to execute fast and invest heavily in the vision, to shut out HTC, Apple, Google and other competitors in the VR space. Regarding other players' participation in the metaverse vision, he called for the company to build the "metaverse" to prevent their competitors from "being in the VR business in a meaningful way at all". In May 2019, Facebook founded Libra Networks, reportedly to develop their own stablecoin cryptocurrency. Later, it was reported that Libra was being supported by financial companies such as Visa, Mastercard, PayPal and Uber. The consortium of companies was expected to pool in $10 million each to fund the launch of the cryptocurrency coin named Libra. Depending on when it would receive approval from the Swiss Financial Market Supervisory authority to operate as a payments service, the Libra Association had planned to launch a limited format cryptocurrency in 2021. Libra was renamed Diem, before being shut down and sold in January 2022 after backlash from Swiss government regulators and the public. During the COVID-19 pandemic, the use of online services including Facebook grew globally. Zuckerberg predicted this would be a "permanent acceleration" that would continue after the pandemic. Facebook hired aggressively, growing from 48,268 employees in March 2020 to more than 87,000 by September 2022. 2021: Rebrand as Meta Following a period of intense scrutiny and damaging whistleblower leaks, news started to emerge on October 21, 2021, about Facebook's plan to rebrand the company and change its name. In the Q3 2021 Earnings Call on October 25, Mark Zuckerberg discussed the ongoing criticism of the company's social services and the way it operates, and pointed to the pivoting efforts to building the metaverse – without mentioning the rebranding and the name change. The metaverse vision and the name change from Facebook, Inc. to Meta Platforms was introduced at Facebook Connect on October 28, 2021. Based on Face.... Discover the Meta S Brown popular books. Find the top 100 most popular Meta S Brown books.

Best Seller Meta S Brown Books of 2024

-

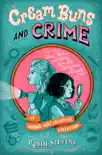

Cream Buns and Crime

Robin StevensLearn more about Daisy and Hazel’s detecting process and unravel three brandnew minimysteries in this short story companion to the Murder Most Unladylike series.Daisy Wells and Haz...